July 31, 2019

USTelecom today released new research on 2018 broadband capital expenditures and an analysis of 2017 FCC broadband deployment data.

Key findings:

- Since 1996, the U.S. broadband industry – wireline, wireless, and cable providers – made capital investments totaling more than $1.7 trillion.

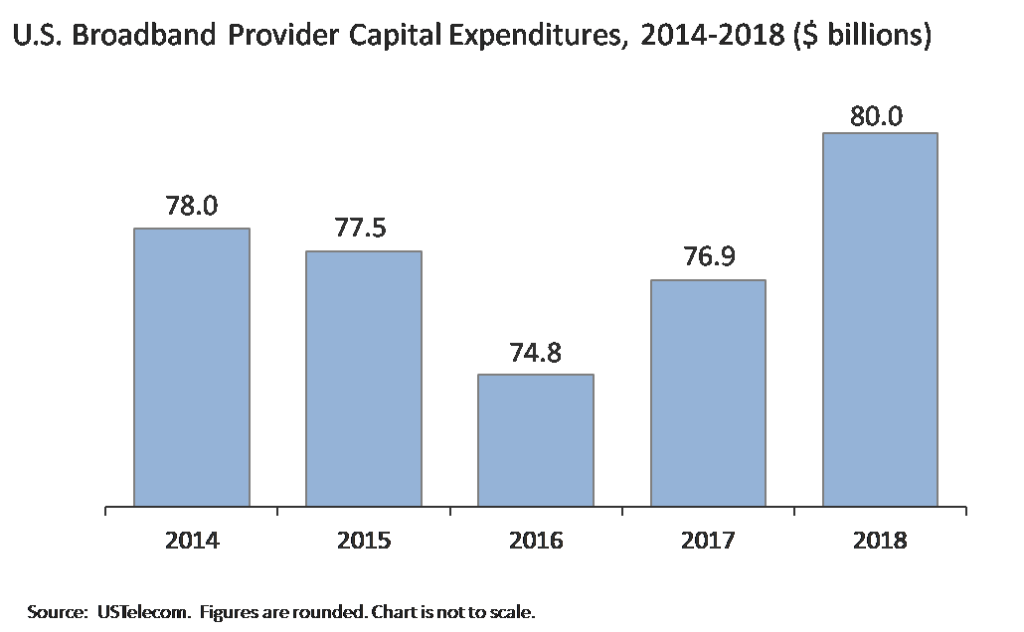

- In 2018, broadband providers invested approximately $80 billion in network infrastructure.

- Annual capital investments have grown for the last two years, following a two-year decline from 2015-2016.

Capital Expenditures

In 2017, broadband provider capital expenditures reversed a two-year decline that started in 2015, when they fell for the first time since the 2008-2009 recession. The 2015 decline of $500 million accelerated to a $2.7 billion decline in 2016. Annual broadband provider capital spending was more than $3 billion lower in 2016 than at the previous peak in 2014.

By contrast, broadband provider capex grew $3 billion in 2018, continuing the upswing that started in 2017 when it grew $2 billion over 2016 levels. In all, 2018 broadband provider capital expenditures were approximately $5 billion greater than in 2016 and had surpassed the recent peak of $78 billion reported in 2014.

In the last two years, industry has spent a total of $7 billion more than it would have had it continued at 2016 spending levels.

The 2015-2016 decline in spending coincided with a Federal Communications Commission (FCC) move to impose common carrier regulatory classification on broadband providers in 2015. The question with respect to the impact of regulation is what investment would have been over the long term under different regulatory scenarios, holding relevant factors constant. Factors include competition, financial market developments, product cycles, government mandates, and taxes. While factors other than regulation are at play, the FCC indicated early in 2017 its intention to pursue a series of pro-investment reforms, including repealing the common carrier classification of broadband. The parallel shifts in broadband policy and capital investment suggest that expectations regarding policy, as well as delivery on those expectations, likely played a role.

Broadband Availability

USTelecom’s analysis of year-end 2017 broadband deployment data demonstrates the benefits of broadband capital investment. The data show more Americans with access to increasing broadband speeds provided over competitive broadband networks. The data also show gaps between rural and urban broadband availability continue to narrow.

At the end of 2017:

- Nearly 99 percent of American homes had access to at least one fixed broadband network.

- 93 percent of American homes had fixed broadband available at 25/3 megabits per second (mbps) download/upload speeds.

- At least one mobile broadband network (using 4G or higher technology), was available to 99.8 percent of American homes.

Demand for broadband data usage continues to grow at double-digit rates every year. Cisco projects U.S. Internet Protocol traffic will triple in the next five years (a compounded annual average growth rate of 21 percent). Competition among broadband providers drives ongoing network upgrades to meet this growing demand.

At the end of 2017:

- 86 percent of Americans had a choice of two or more wired broadband networks at any speed.

- 56 percent of Americans had a choice of two or more wired broadband providers at 25/3 mbps, up 25 percentage points since 2015.

- 98 percent of Americans had a choice of three or more mobile broadband providers.

USTelecom’s analysis of the FCC deployment data shows the benefits of competitive investment in the form of increasing speeds and upgraded networks.

At the end of 2017:

- 88 percent of American homes had fixed broadband available at 100/10 mbps, an 18 percentage point increase in one year.

- Fiber-to-the-home reached 31 percent of American homes.

Urban/Rural Divide Narrowing

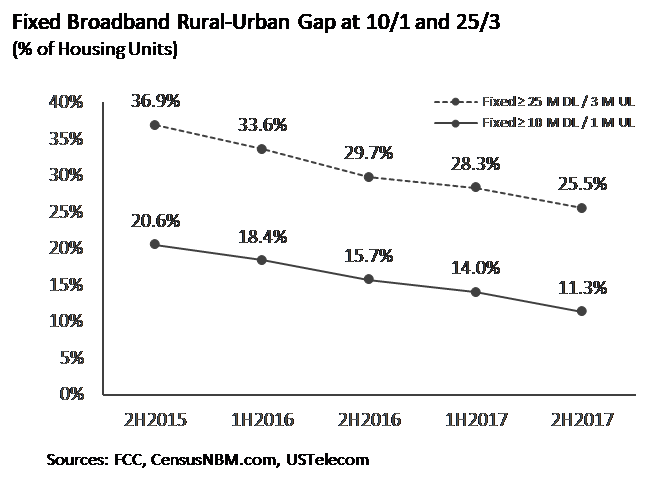

USTelecom’s analysis shows the gaps between urban and rural broadband deployment narrowing, demonstrating the benefits of both private investment incentives and targeted government support for broadband deployment in economically challenged rural areas.

- At the 10/1 mbps threshold required by the FCC’s Connect America Fund program, the difference between fixed urban and rural broadband availability fell from 21 percentage points in 2015 to 11 percentage points in 2017.

- At 25/3 mbps, the difference fell from 37 percentage points in 2015 to 26 percentage points in 2017.

- The availability of rural broadband at 100/10 mbps grew 18 percentage points in 2017, to 58 percent.

Broadband investment remains critical to modernizing our nation’s network infrastructure, maintaining international leadership, and closing the digital divide. While progress is strong and ongoing, the need to upgrade networks is constant. Moreover, significant challenges remain in eliminating rural broadband gaps. It will be necessary to maintain a policy environment that encourages greater investment to meet ever-growing demand for data usage as well as the need to expand networks further into currently unserved areas.